An expenditure report is a document that lists all of the costs associated with administering a business. Employees may be asked to file expense reports to be reimbursed for business-related items such as gas or meals. Alternatively, a small business owner might use expense reports to track project expenditure and prepare for tax season.

expense reports are required for small enterprises with employees who frequently pay for business costs out of pocket. All reimbursable expenses will be itemized on the employee’s expense report. Receipts should also be attached to the expense report. The owner can then double-check the expense report for correctness before paying the employee the full amount. A small business owner can also use expense reports to analyze their total spending for a specific reporting period–usually a month, quarter, or year. The owner might examine the results to discover if total expenditure were more or lower than predicted.

What Is the Purpose of an Expense Report?

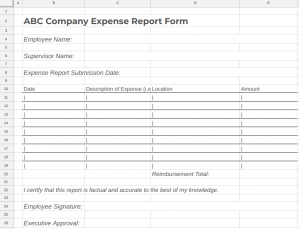

An expense report is a document that keeps track of how much money a company spends. According to Entrepreneur, an expense report form contains any purchases required to run a trade, such as food, parking, gas, or motels. Bookkeeping software or a pattern in Word, PDF, Excel, or other common programs can be used to create an expense report.

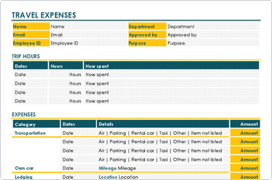

HOW DOES AN EXPENSE REPORT APPEAR?

Columns on an expense report often include:

- Date: the item was acquired on this date.

- The place where the item was purchased is referred to as the vendor.

- Client: For whom was the item purchased?

- What is the project for which the item was purchased?

- An account number can be used instead of a customer or project number.

- Author: the person who bought the item

- Notes: a few more clarifications

- The entire cost of the expense, including taxes, is the amount.

An expenditure report in its most basic form is shown below. This report calculates expenditure based on tax categories, such as rent. There is a subtotal for each category, followed by a total. Create an outlay report based on a date range, then export or print it.

Expense Reporting System Selection

When choosing a disbursement management solution, adopt best practices and keep a few suggestions in mind, just as you would with any software installation project:

Begin by conducting a finding and development phase, which includes crucial scheme needs based on specific cost management workflows, and researching and selecting a system.

Inquire about the purchase, setup, and customization costs and ongoing and indirect fees for updates, customer support, software license renewals, and other services.

Check to see if the solution can be adjusted to fit your company’s operations and rules without requiring a lot of developer time. It might be a better bet to see if your procedures can be changed to fit the software, keeping in mind that it was designed to handle the demands of hundreds or thousands of businesses.

Select a scheme with mobile abilities, well-designed functionality, and an appealing UI that appeals to today’s multi-generational workforces that is simple to use for all employees—those who report, favour and examine.

Allocate enough resources to give all users with training and technical support.

Take the time to eliminate obsolete customer accounts and check for discrepancies before migrating all historical data to the new system.

Accounting and project costing systems are deeply integrated.